Important information about YG Financial Services Limited

Licensing Information

YG Financial Services Limited (trading as Your Generation Financial Services) holds Financial Advice Provider (FAP) licence issued by the Financial Markets Authority, effective from 27th September 2021, with registration number FSP705651. We are regulated by the Financial Markets Authority (FMA). For more details about our registration, please refer to https://fsp-register.companiesoffice.govt.nz here.

YG Financial Services Limited (referred to as “YGFS” or "we" or "us"), is authorised to provide financial advice services under the Financial Advice Provider Class 2 License under the FAP licence.

Nature and Scope of the Advice

YG Financial Services Limited’s Financial Advisers specialise in providing financial advice on KiwiSaver, risk insurance, health insurances, international student insurance and travel insurance. Our financial advisers are agents for AON to distribute their stylecover fire and general products. We don’t provide market advice on fire and general insurance.

Our primary objective is to assist clients in safeguarding their health, income, assets, and liabilities to mitigate financial repercussions in adverse circumstances.

We refer business that is out of our scope of advice. Please visit our sister company 'YG General Limited' for Fire and General Insurance (Domestic, SME and Commercial Insurance) advice.

We do not provide advice on bank insurance products and direct insurer products.

We do have some limitations or restrictions on the scope of the financial advice services we offer. In the event of any such limitations or restrictions, we will promptly disclose them to you.

Product Providers

YG Financial Services Limited offers financial advice on a wide range of products from various New Zealand-based and overseas providers. We provide financial advice and distribute products from the following providers:

How We Operate

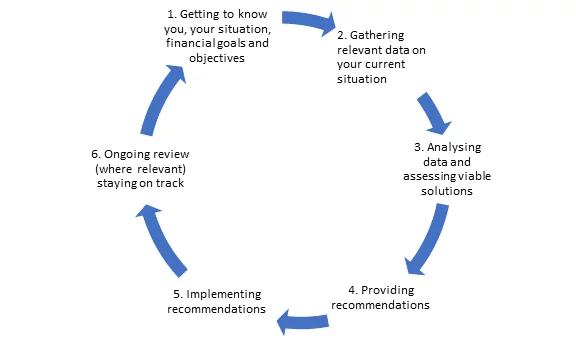

To ensure that our financial advisers prioritise the client’s interests above their own, we follow an internationally recognised professional advice process to ensure our recommendations are made on the basis of the client’s goals and circumstances.

Duties Information

YG Financial Services Ltd and anyone who gives financial advice on our behalf have duties under the Financial Markets Conduct Act 2013 relating to the way that we give advice.

We are required to:

- give priority to your interests by taking all reasonable steps to make sure our advice isn’t materially influenced by our own interests;

- exercise care, diligence and skill in providing you with advice;

- meet standards of competence, knowledge and skill as set by the Code of Professional Conduct for Financial Advice Services.

- meet standards of ethical behaviour, conduct and client care set by the Code of Professional Conduct for Financial Advice Services.

These are designed to make sure we treat you as we should and give you suitable advice.

This is only a summary of the duties that we have. More information is available by contacting us, or by visiting the FMA website here.

Fees, Expenses, or Other Amounts Payable

YG Financial Services Ltd receives commissions based on the business you place with the providers we work with. We typically do not charge fees or expenses; however, if we do, further details are listed below.

For Health and Risk insurance advice, YG Financial Services Ltd may charge a fee, at their discretion, for the financial advice provided to you. This fee will be calculated on the following basis: a base advice fee of between $500 - $2000 (including GST), then $200 (inc GST) per hour after the first 10 hours. This fee will be discussed further with you when determining the Scope of the advice. The fee will be payable after the Statement of Advice has been provided to you by the 20th of the month.

For Health and Risk insurances, YG Financial Services Ltd may charge a fee for the financial advice provided to you when you cancel a health or life insurance policy within two years of inception. Whether a fee will be charged and the manner in which it will be charged will be advised. This fee will be payable by you by the 20th of the month after the policy is cancelled. This fee is also known as a clawback charge. *

For KiwiSaver advice, a fee of $150 is applied if you choose to invest with Milford Investment. For NZ Funds and Generate products, there are no initial advice fee.

All KiwiSaver providers pay a commission to YG Financial Services Ltd, and the financial adviser based on the total amount of fund held in the portfolio.

If fees are charged, fees for advice and implementation are based on the complexity and time required, and they will be clearly outlined in your invoice. Adjustments to your insurance during the policy period may also incur a fee, which will be indicated on your invoice.

YG Financial Services Ltd reserves the right to waive this fee at their discretion if the client continues to use their services to organise replacement finance.

* A clawback is where a payment received from product providers for business placed, is reversed due to the policy being cancelled within a two-year period.

Conflicts of Interest and Incentives

We want to be transparent regarding potential conflict of interests.

- Yang Gu and Channel Lee, directors at YG Financial Services Ltd, also serve as directors at YG General Ltd. While we are dedicated to managing this conflict effectively, we believe it's important to inform you so you can make informed decisions. We assure you that we have internal processes to mitigate any conflicts. If you have questions, please reach out.

- When arranging insurance, providers pay YG Financial Services Ltd and the financial adviser a commission based on the amount of the premium. In the event of policy cancellation and commissions clawback, a professional advice fee may be charged to you for the time spent on providing advice.

- Referral arrangements may involve us paying a percentage of commissions and/or fees to the referring entity. If conflicts of interest arise, we will disclose them and take appropriate action to ensure your interests are prioritised.

Our financial advisers are committed to prioritising your interests above their own, and we maintain a register of conflicts, gifts, and incentives to uphold transparency.

All our financial advisers undergo annual training on how to manage conflicts of interest. We undertake a compliance audit, and a review of our compliance programme annually by a reputable compliance adviser.

Commissions:

From time to time, product providers may also reward our financial advisers for the overall business we provide to them. They may give us but not limited to tickets to sports events, hampers or other incentives.

Complaints Handling & Dispute Resolution

For information about our internal complaints process, please refer to our Complaints and Disputes process

here.Contact Information

Phone: 09 413 5027

Email: info@yourgeneration.co.nz

Address: A1/17 Corinthian Drive, Albany, Auckland 0632

Website: www.yourgeneration.co.nz